Using spreadsheets for personal finance is one of the most effective ways to gain control over your money and make informed decisions about your financial future. While there are countless apps and tools available today, spreadsheets offer a level of customization, transparency, and simplicity that many people find empowering. Whether you’re managing a monthly budget, tracking expenses, planning for retirement, or analyzing debt repayment strategies, a well-structured spreadsheet can serve as both a financial dashboard and a decision-making tool.

At its core, a spreadsheet is a grid of cells that can hold numbers, text, and formulas. That might sound basic, but the power lies in how those elements interact. For personal finance, this means you can create dynamic models that automatically update as your inputs change. For example, if you’re tracking your monthly income and expenses, you can set up formulas that calculate your total spending, compare it to your income, and show your net savings. This gives you a real-time snapshot of your financial health and helps you identify patterns or areas where you might need to adjust.

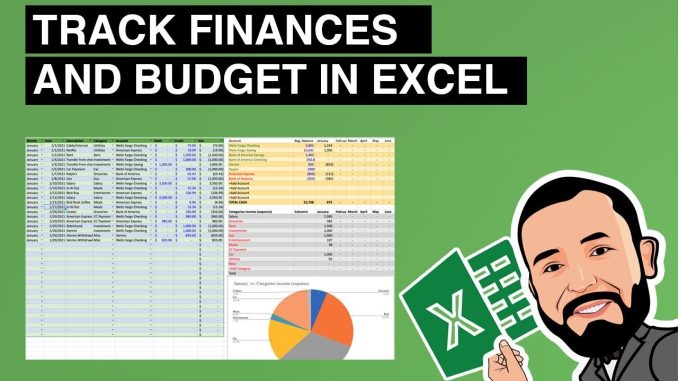

One of the most common uses of spreadsheets is budgeting. A simple budget spreadsheet might include categories like housing, transportation, food, entertainment, and savings. You can enter your planned spending for each category and then track your actual expenses throughout the month. By comparing the two, you can see where you’re staying on track and where you’re overspending. This kind of visibility is crucial for making intentional choices with your money. It’s not just about cutting costs—it’s about aligning your spending with your values and goals.

Spreadsheets also shine when it comes to tracking debt. Suppose you have multiple loans or credit cards with different interest rates and payment schedules. You can build a spreadsheet that lists each debt, its balance, interest rate, minimum payment, and due date. From there, you can create a repayment plan, such as the snowball or avalanche method, and use formulas to project how long it will take to pay everything off. Seeing the numbers laid out clearly can be incredibly motivating, especially when you start to visualize the impact of extra payments or lower interest rates.

Savings goals are another area where spreadsheets can be transformative. Whether you’re saving for a vacation, a down payment, or an emergency fund, you can create a tracker that shows your progress over time. By entering your target amount and your monthly contributions, the spreadsheet can calculate how long it will take to reach your goal. You can even add visual elements like charts or conditional formatting to make the experience more engaging. Watching your savings grow, even in small increments, reinforces positive habits and keeps you focused on the bigger picture.

For those who want to dive deeper, spreadsheets can also be used for investment tracking and financial forecasting. You can input your portfolio holdings, track performance over time, and analyze asset allocation. If you’re planning for retirement, you can model different scenarios based on expected returns, inflation, and contribution rates. This kind of analysis helps you make strategic decisions and adjust your plan as needed. While it requires a bit more financial knowledge, the spreadsheet format allows you to experiment and learn in a hands-on way.

One of the key advantages of using spreadsheets is the ability to customize them to your specific needs. Unlike pre-built apps, which often come with fixed categories and limited flexibility, spreadsheets let you design your own system. You can add notes, create dropdown menus, link multiple sheets together, and build formulas that reflect your unique financial situation. This level of control can be especially helpful if your finances are complex or if you want to incorporate non-traditional income sources, irregular expenses, or shared budgets with a partner.

Of course, the effectiveness of a spreadsheet depends on how consistently you use it. It’s easy to set up a beautiful budget and then forget to update it. To get the most out of your spreadsheet, it helps to establish a routine—perhaps reviewing it weekly or monthly, depending on your needs. Over time, this habit becomes second nature, and the spreadsheet evolves into a living document that reflects your financial journey. It’s not just a tool—it’s a companion that helps you stay accountable and make smarter choices.

For those new to spreadsheets, starting simple is the best approach. You don’t need advanced formulas or complex layouts to begin. Even a basic income-and-expense tracker can provide valuable insights. As you become more comfortable, you can explore additional features like pivot tables, charts, and conditional formatting. There are also plenty of templates available online that can serve as inspiration or starting points. The important thing is to make the spreadsheet your own—something that feels intuitive and useful to you.

Ultimately, using spreadsheets for personal finance is about empowerment. It’s about taking ownership of your financial life and building a system that supports your goals. Whether you’re trying to get out of debt, save for the future, or simply understand where your money goes, a spreadsheet can be a powerful ally. It brings clarity to complexity, turns numbers into narratives, and helps you make decisions with confidence. In a world full of financial noise, that kind of clarity is not just helpful—it’s transformative.