Creating a legacy of protection for your loved ones is not simply about accumulating wealth or drafting a will—it’s about crafting a thoughtful, enduring framework that safeguards their future, even in your absence. It’s a concept that blends financial foresight with emotional responsibility, recognizing that the most meaningful gifts are often those that provide stability, security, and peace of mind. Whether you’re a business owner, a parent, or someone planning for retirement, the decisions you make today can echo for generations, shaping not just financial outcomes but the values and resilience of those you care about most.

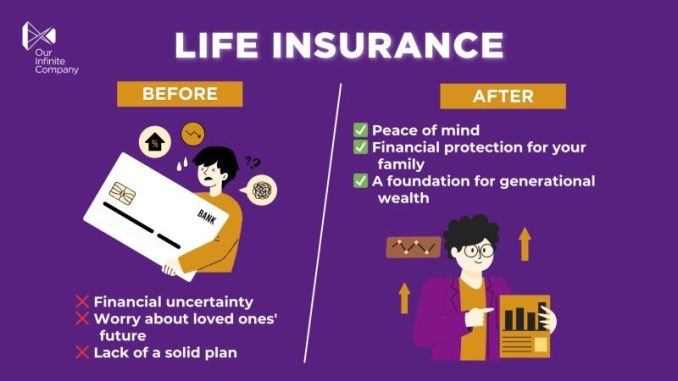

At the heart of this legacy is the understanding that life is unpredictable. Illness, accidents, economic shifts, and natural disasters can disrupt even the most carefully laid plans. Protection, in this context, means preparing for those uncertainties with tools that absorb shock and preserve continuity. Insurance plays a central role in this strategy, offering mechanisms to replace income, cover expenses, and shield assets from erosion. Life insurance, for example, is often viewed as a transactional product, but in reality, it’s a powerful expression of care. It ensures that your family can maintain their lifestyle, pay off debts, and pursue goals without financial strain. The right policy, tailored to your circumstances, becomes a cornerstone of your legacy.

But protection goes beyond insurance. It involves structuring your finances in a way that supports long-term sustainability. Estate planning is a critical component, encompassing wills, trusts, powers of attorney, and healthcare directives. These instruments clarify your intentions, reduce the risk of disputes, and facilitate smooth transitions. A well-designed trust can preserve assets for future generations, protect beneficiaries from creditors, and even incentivize certain behaviors, such as education or charitable giving. The goal is not just to transfer wealth, but to do so in a way that reflects your values and supports your loved ones in meaningful ways.

Education is another pillar of protection. Teaching family members about financial literacy, risk management, and responsible stewardship empowers them to make informed decisions. It’s one thing to leave behind resources; it’s another to ensure those resources are used wisely. Conversations about budgeting, investing, and insurance should be part of family life, not reserved for moments of crisis. By fostering a culture of transparency and shared responsibility, you help your loved ones build their own resilience and confidence. This kind of legacy is intangible but deeply impactful, shaping attitudes and habits that endure.

Business owners face unique challenges in building a legacy of protection. Their personal and professional lives are often intertwined, and the continuity of the business can be critical to family well-being. Succession planning becomes essential, ensuring that leadership transitions are smooth and that the enterprise remains viable. Key person insurance, buy-sell agreements, and contingency plans all contribute to this effort. They protect not only the financial interests of the business but also the livelihoods of employees and the expectations of clients. A business that survives and thrives beyond its founder becomes a living legacy, one that reflects vision, discipline, and care.

Charitable giving can also be part of a protective legacy. Establishing a foundation, endowment, or donor-advised fund allows you to support causes that matter to you while involving your family in philanthropic efforts. This not only amplifies your impact but also instills a sense of purpose and connection. It’s a way to extend your values into the community and to inspire future generations to think beyond themselves. Protection, in this sense, is not just about shielding from harm—it’s about nurturing growth and opportunity.

Technology is reshaping how legacies are built and maintained. Digital tools enable more precise financial planning, easier access to documents, and real-time monitoring of investments and insurance policies. Online platforms allow families to collaborate across distances, share information securely, and stay informed about key decisions. These innovations enhance transparency and efficiency, but they also require vigilance. Cybersecurity, data privacy, and digital estate planning are emerging concerns that must be addressed to ensure that protection remains intact in a digital age.

Ultimately, building a legacy of protection is a dynamic process. It requires ongoing attention, regular reviews, and a willingness to adapt as circumstances change. Life events such as marriage, birth, retirement, or health changes can all impact your strategy. Staying engaged with advisors, updating documents, and revisiting goals ensures that your legacy remains relevant and effective. It’s not a one-time task—it’s a lifelong commitment to those you love.

What makes this kind of legacy powerful is its blend of practicality and emotion. It’s rooted in numbers and contracts, but it’s driven by care and intention. It says, “I’ve thought about you. I’ve planned for you. I’ve taken steps to protect you.” That message, delivered through thoughtful action, resonates far beyond financial statements. It becomes part of your story, a testament to your values, and a gift that continues to give. In a world full of uncertainty, that kind of protection is not just valuable—it’s profound.