Insurance is one of those financial tools that people often misunderstand, and unfortunately, those misconceptions can lead to costly mistakes. Whether it’s overpaying for coverage, underinsuring valuable assets, or skipping policies altogether, believing common insurance myths can quietly drain your finances over time. These myths persist because insurance is complex, filled with jargon, and rarely something people enjoy thinking about until they need it. But taking the time to separate fact from fiction can make a significant difference in how well you’re protected—and how much you’re spending.

One of the most pervasive myths is the idea that insurance is only necessary for worst-case scenarios. While it’s true that insurance provides a safety net during major events like accidents, illnesses, or natural disasters, its value goes beyond catastrophic coverage. Many policies offer benefits for routine or moderate issues that can still be financially disruptive. For example, health insurance isn’t just for hospital stays—it also covers preventive care, prescriptions, and specialist visits. Skipping coverage because you feel healthy or think you’ll “beat the odds” can backfire quickly. A single unexpected diagnosis or injury can lead to thousands in out-of-pocket costs, far outweighing the premiums you might have saved.

Another costly myth is assuming that your employer-provided insurance is sufficient. While workplace benefits are a valuable starting point, they often come with limitations. Group health plans may not cover certain treatments or specialists, and life insurance policies offered through employers are typically modest in value. If you change jobs or lose employment, those benefits may disappear entirely. Relying solely on employer coverage can leave gaps that become apparent only when it’s too late. Supplementing with individual policies or reviewing your coverage regularly ensures that your protection evolves with your circumstances.

Many people also believe that renters don’t need insurance because the landlord’s policy will cover damages. This misconception can be expensive. A landlord’s insurance typically protects the building itself, not the tenant’s personal belongings. If a fire, flood, or theft occurs, renters without insurance may have to replace everything out of pocket. Renters insurance is relatively inexpensive and often includes liability coverage, which can protect you if someone is injured in your home. Ignoring this type of policy because of false assumptions can lead to significant financial exposure.

There’s also a widespread belief that red cars cost more to insure. While it’s a popular notion, the color of your vehicle has no impact on insurance premiums. What matters are factors like the make and model, safety features, repair costs, and your driving history. Believing this myth might lead someone to avoid a preferred vehicle or make decisions based on irrelevant criteria. Understanding what actually influences auto insurance rates—such as mileage, location, and claims history—can help you make smarter choices and potentially reduce costs.

Another myth that can cost you money is thinking that home insurance covers everything. Standard homeowners policies have exclusions and limits that many people don’t realize until they file a claim. For instance, flood damage is typically not covered unless you have a separate flood insurance policy. Similarly, high-value items like jewelry, art, or electronics may require additional riders to be fully protected. Assuming you’re covered without reviewing the specifics can result in denied claims and unexpected expenses. Taking the time to understand your policy and customize it to your needs is a proactive way to avoid financial surprises.

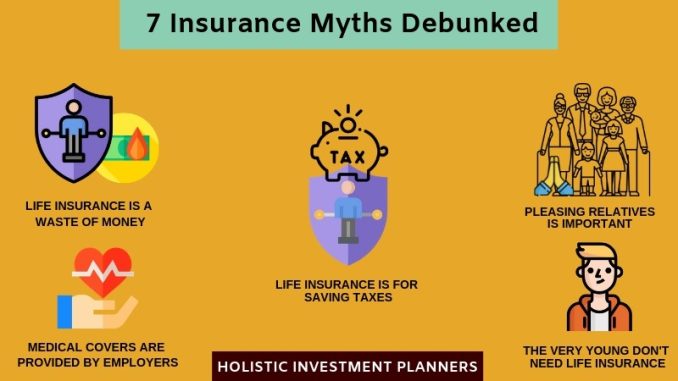

Some individuals believe that life insurance is only necessary for those with dependents. While it’s true that life insurance is crucial for protecting families, it can also serve other purposes. For example, it can help cover funeral expenses, pay off debts, or leave a legacy to charitable organizations. Even single individuals may want to consider coverage if they have co-signed loans, aging parents, or business partners. Delaying life insurance because you think it’s not relevant can lead to higher premiums later, especially if health issues arise. Locking in a policy while you’re young and healthy is often more affordable and provides long-term security.

A particularly damaging myth is the idea that filing a claim will always raise your premiums. While claims can influence rates, not all claims have the same impact. Insurers consider the type, frequency, and severity of claims when adjusting premiums. A single, minor claim may have little to no effect, especially if you have a clean history. Avoiding necessary claims out of fear can leave you paying for damages that should have been covered. It’s important to weigh the cost of repairs against your deductible and potential rate changes, rather than assuming the worst.

Finally, there’s the belief that insurance is a “set it and forget it” product. Life changes—such as marriage, having children, buying a home, or starting a business—can dramatically alter your insurance needs. Failing to update your policies can result in inadequate coverage or missed opportunities for savings. For instance, bundling home and auto insurance with the same provider often leads to discounts, but many people overlook this option. Regularly reviewing your policies ensures that they remain aligned with your goals and lifestyle, helping you avoid both overpayment and underprotection.

Dispelling these myths requires a shift in mindset. Insurance isn’t just a necessary expense—it’s a strategic tool for managing risk and preserving financial stability. By questioning assumptions, seeking professional advice, and staying informed, you can make smarter decisions that protect your assets and reduce unnecessary costs. In a business context, where margins matter and risk is ever-present, understanding the realities of insurance is not just prudent—it’s essential. Whether you’re an entrepreneur, a homeowner, or simply someone trying to make the most of your financial resources, separating myth from fact is a step toward greater confidence and control.