In the complex tapestry of modern life, where unforeseen events and risks are an undeniable reality, insurance stands as a crucial safeguard, offering a vital layer of financial protection and peace of mind. However, the true value of an insurance policy only materializes at the moment of need, through a process known as an insurance claim. Far more than a mere formality, an insurance claim is the formal request an insured individual or entity makes to their insurance provider for compensation or coverage under the terms of their policy. Understanding what an insurance claim entails and how it meticulously works is paramount for policyholders to effectively leverage their coverage when unforeseen circumstances strike, whether personally or in a business context.

At its essence, an insurance claim is the mechanism by which the insured seeks to receive the benefits outlined in their insurance contract. This contract, the policy, is a legally binding agreement detailing the conditions under which the insurer will compensate the policyholder for covered losses. For instance, if a business experiences a fire that damages its premises, it would file a property insurance claim. If an individual is involved in a car accident, they would initiate an auto insurance claim. The claim is essentially the trigger that prompts the insurance company to investigate the event and, if valid, provide the agreed-upon financial relief or service.

The process of filing an insurance claim typically begins with the **notification of loss or damage** to the insurance company. This should happen as soon as reasonably possible after the incident occurs. Many insurance providers offer multiple channels for notification, including phone hotlines, online portals, or even mobile apps. This initial contact is crucial as it formally alerts the insurer to a potential claim and allows them to begin their internal procedures. During this notification, the policyholder will usually be asked to provide basic details about the incident, such as the date, time, location, a brief description of what happened, and their policy number. For instance, in Thailand, a motorist involved in a minor collision might immediately call their insurer’s hotline from the scene to report the incident and receive immediate guidance.

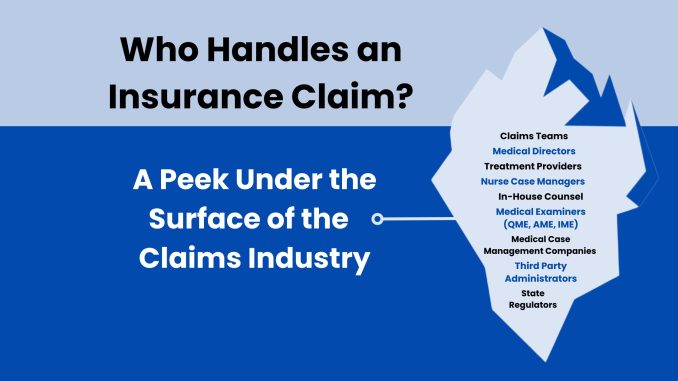

Following the initial notification, the insurance company will typically **assign a claims adjuster** or a claims representative to the case. This individual or team is responsible for investigating the claim, verifying the details of the incident, assessing the extent of the damage or loss, and determining the validity of the claim based on the terms and conditions of the policy. The adjuster might conduct interviews with the policyholder, witnesses, or third parties involved. They may also inspect the damaged property, review medical records (in the case of health or life insurance claims), or analyze police reports. This investigative phase is critical; it ensures that the claim is legitimate and falls within the scope of the coverage purchased. For a business, this might involve an adjuster visiting a damaged factory to assess the scope of repairs and inventory loss.

During the investigation, the policyholder has a crucial role to play: **cooperation and documentation**. It is imperative to provide all requested information and documentation accurately and promptly. This includes photographs of damage, receipts for damaged items, medical bills, police reports, and any other relevant evidence that supports the claim. The more detailed and organized the documentation, the smoother the claims process tends to be. Failing to provide necessary information or being uncooperative can significantly delay or even jeopardize the claim’s approval. Maintaining clear records, from policy documents to communication logs, can prove invaluable throughout this stage.

Once the investigation is complete, the claims adjuster will **evaluate the findings against the policy’s terms**. This involves determining if the loss is covered by the policy, calculating the amount of eligible compensation, and applying any deductibles or policy limits. A deductible is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. For example, if a car repair costs ฿50,000 and your deductible is ฿5,000, the insurance company would pay ฿45,000. Policy limits define the maximum amount the insurer will pay for a covered loss. Transparency during this phase is important, and policyholders should feel empowered to ask questions if they don’t understand the calculations or decisions.

Finally, if the claim is approved, the insurance company will **issue a settlement** to the policyholder. This settlement can take various forms: a direct payment to the policyholder, a payment made directly to a repair shop or medical provider, or a replacement of damaged property. The method of settlement will depend on the type of insurance and the nature of the claim. Throughout this process, clear and consistent communication from the insurer is ideal, keeping the policyholder informed of the status and next steps.

It is important to recognize that not all claims are approved. A claim might be denied if the incident is not covered by the policy, if there are policy exclusions that apply, if the policyholder failed to pay premiums, or if there is insufficient evidence to support the claim. In such cases, policyholders usually have the right to appeal the decision, providing additional information or clarification.

In conclusion, an insurance claim is the operational heart of any insurance policy, translating the promise of protection into tangible financial relief. It is a structured process involving prompt notification, thorough investigation, meticulous documentation, and a careful evaluation against policy terms. By understanding these steps and actively cooperating with their insurer, policyholders can navigate the claims process effectively, ensuring they receive the full benefits of their coverage when they most need it, providing vital financial security amidst life’s unpredictable challenges.